OpenAI and Apple design legend Jony Ive are building the iPhone of the AI age

PARIS, June 16 — Nvidia CEO Jensen Huang has been pitching the idea of “sovereign AI” since 2023. Europe is now starting to listen and act.

The concept is based on the idea that the language, knowledge, history and culture of each region are different, and every nation needs to develop and own its AI.

Last week, the CEO of the artificial-intelligence chipmaker toured Europe’s major capitals – London, Paris and Berlin – announcing a slew of projects and partnerships, while highlighting the lack of AI infrastructure in the region.

In a place where leaders are increasingly wary of the continent’s dependency on a handful of US tech companies and after drawing ire from the US President Donald Trump, his vision has started to gain traction.

“We are going to invest billions in here ... but Europe needs to move into AI quickly,” Huang said on Wednesday in Paris.

On Monday of last week, British Prime Minister Keir Starmer announced 1 billion pounds (US$1.35 billion) in funding to scale up computing power in a global race “to be an AI maker and not an AI taker.”

French President Emmanuel Macron called building AI infrastructure “our fight for sovereignty” at VivaTech, one of the largest global tech conferences.

After Nvidia laid out plans to build an AI cloud platform in Germany with Deutsche Telekom, German Chancellor Friedrich Merz called it an “important step” for the digital sovereignty and economic future of Europe’s top economy.

Europe lags behind both the US and China as its cloud infrastructure is mostly run by Microsoft, Amazon and Alphabet’s Google, and it has only a few smaller AI companies such as Mistral to rival the US ones.

“There’s no reason why Europe shouldn’t have tech champions,” said 31-year-old Mistral CEO Arthur Mensch, sitting beside Huang, who has led Nvidia for more than three decades, at a panel at VivaTech.

“This is a gigantic dream.”

Gigafactory plans unleashed

In France, Mistral has partnered with Nvidia to build a data centre to power the AI needs of European companies with a homegrown alternative.

It will use 18,000 of the latest Nvidia AI chips in the first phase, with plans to expand across multiple sites in 2026. In February, the European Union announced plans to build four “AI gigafactories” at a cost of US$20 billion to lower dependence on US firms.

The European Commission has been in touch with Huang and he had told the EU executive that he was going to allocate some chip production to Europe for these factories, an EU official told Reuters.

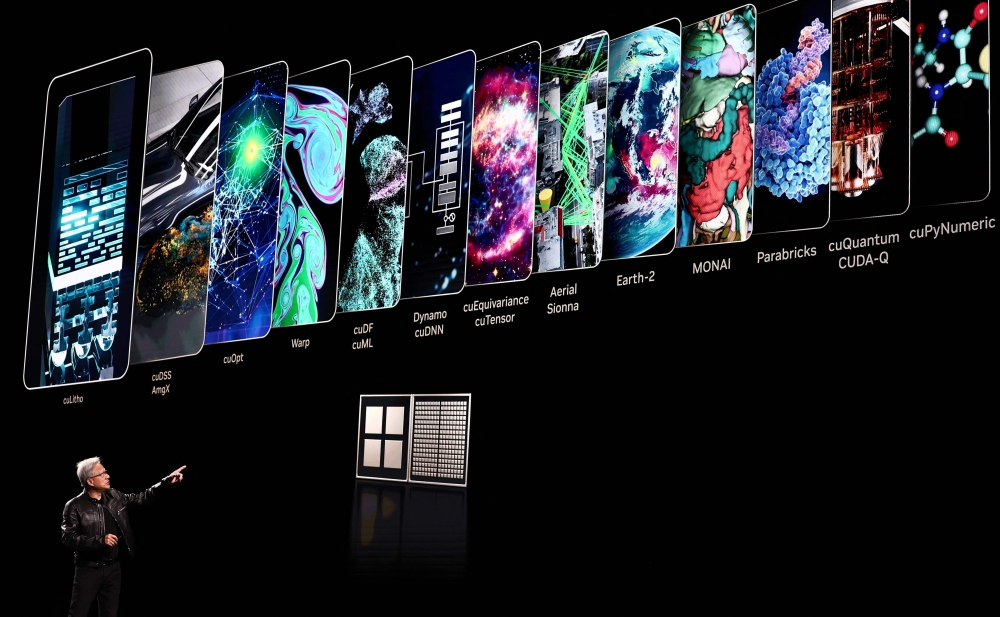

Nvidia’s chips known as Graphics Processing Units or GPUs are crucial for building AI data centres from the US to Japan and India to the Middle East.

In Europe, a push for sovereign AI could reshape the tech landscape with domestic cloud providers, AI startups, and chipmakers standing to gain from new government funding and a shift toward in-region data infrastructure.

Nvidia also wants to cement demand for its AI chips, ensuring that even as countries seek independence, they still rely on its technology to get there.

Power costs

The push is not without challenges. High electricity costs and rising demand could strain sourcing of electricity for data centres. Data centres account for 3 per cent of EU electricity demand, but their consumption is expected to increase rapidly this decade due to AI.

Mistral, which has raised just over US$1 billion, is trying to become a European homegrown champion with a fraction of the money US hyperscalers or large data-centre operators spend in a month.

“Hyperscalers are spending US$10 billion to US$15 billion per quarter in their infrastructure. Who in Europe can afford that exactly?” said Pascal Brier, chief innovation officer at Capgemini, a partner of both Nvidia and Mistral.

“It doesn’t mean we shouldn’t do anything, but we have to be cognizant about the fact that there will always be a gap.”

Mistral has launched several AI models which are used by businesses but companies tend to mix them with models from other companies such as OpenAI, Anthropic and Meta Platforms.

“Most of the time it’s not Mistral or the rest, it’s Mistral and the rest,” Brier said.(US$1 = 0.7393 pound) — Reuters